blog

Realizing 5G network slicing monetization opportunities

Each path to network-slicing revenues is defined by unique business, technological and operational challenges that require strategic planning. That’s part of the reason why many of today’s communication service providers (CSPs) are turning to experienced specialists for advice about how to simplify and accelerate their network-slicing evolution. In the first of our two-part network-slicing blog series, our experts share key insights based on their work with some of the world’s leading CSPs.

Network slicing is a near-term opportunity. It’s expected to help drive the 5G standalone (SA) monetization journey and is seen as one of the enablers for B2X or B2B2X services. To seize these network slicing opportunities, CSPs are gearing up by testing a wide range of strategies and use cases, with frontrunners having already executed technical or commercial proofs of concept and successfully launched several slicing products.

Figure 1. For CSPs, network slicing provides numerous advantages such as customized functionality, quicker scale-up and time-to-market, and the generation of new revenue prospects.

2023 and beyond: how are the frontrunners approaching network slicing opportunities?

Looking at industry frontrunners yields valuable insights into how they’re attempting to bring network slicing to the market. At Ericsson Consulting we see clear trends in relation to strategy choices and top verticals/use cases being pursued.

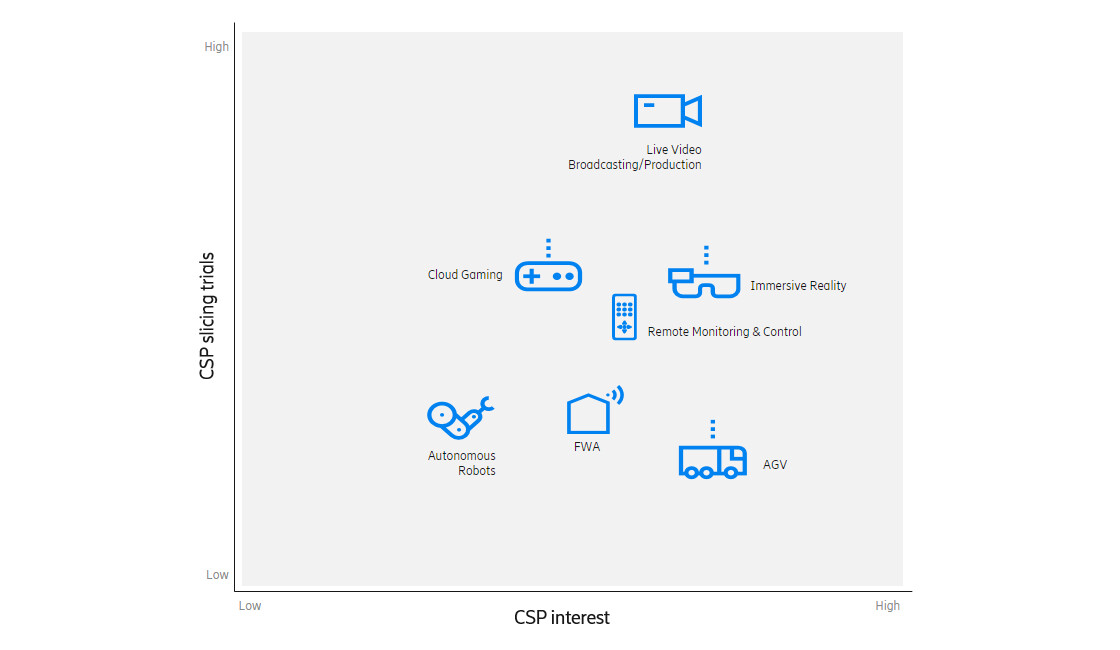

Figure 2. The three top choices CSPs are making.

Figure 3. shows the seven most popular use cases based on the number of slicing trials identified from CSPs.

Beginning your journey: How to tackle key priorities

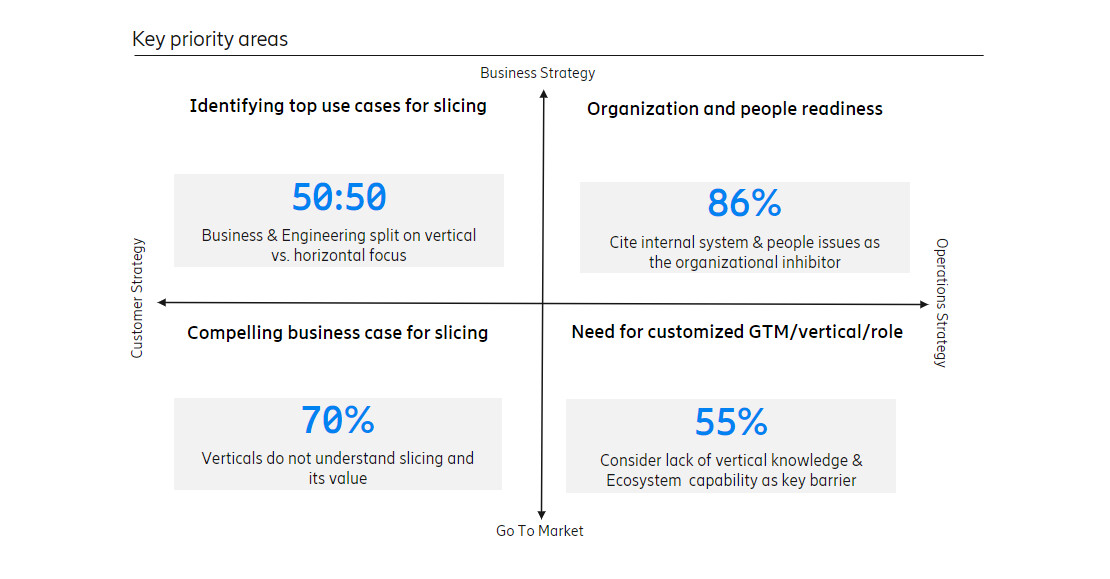

Figure 4. The key priorities CSPs must address on their network slicing journey.

Even though we see a lot of activity from CSPs, network slicing is a new technology and, as with any new technology, there are areas that need specific focus to enable wide-scale adoption. From our perspective, there are four key priority areas that all CSPs need to tackle to enable a long-term strategic approach, which are:

- Identifying top use cases for slicing: CSPs are still struggling to determine which is the best vertical/best use case to pursue. Whether to use vertical use cases vs horizontal use cases. For example, slices for the Advanced Driver Assistance Systems are very specifically created for the automotive vertical, whereas horizontal use cases, such as AR/VR, and remote control, are applicable to multiple verticals. While the slicing use cases being pursued globally provide direction, the answer to which use cases/verticals to target requires a thoughtful methodical analysis based on the local market and CSP realities.

- Defining compelling business cases for slicing: Verticals/enterprises want proof points, but the industry is in the early stages of trialing this technology and building proof points – a catch-22 situation. Hence it is extremely important to educate enterprises on the benefits of slicing and engage in trials to create such proof points.

- Determining how to bring slicing to the market: We believe that every vertical will have unique go-to-market (GTM) models. This would require CSPs to have a detailed understanding of the needs and challenges of every vertical that they want to target.

- Implementing operational readiness: Slicing is a fundamental shift in the way the network is deployed and offered. Hence, there is a strong need for CSPs to enable their organization to be able to deploy, manage and sell network slicing. CSPs will need AGILE and DevOps capabilities to add flexibility in ways of working, enhance capabilities within the organization, and integrate processes to manage network slicing, which will require a level of organizational transformation. From our viewpoint, this is one of the key priority areas – and something that takes time. It should therefore be started in parallel with technical and business planning.

Addressing these key areas and creating a strategy

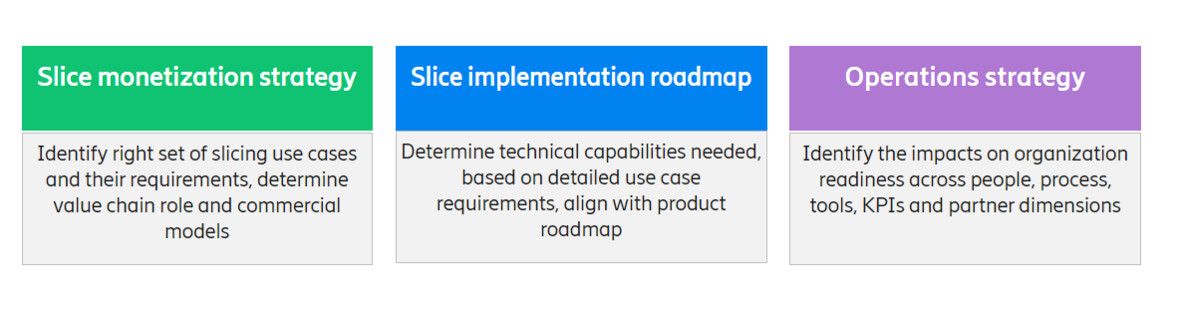

Overall, Ericsson Consulting believes that CSPs need to define a clear long-term network-slicing monetization strategy that brings together the following business, technology, and operational aspects:

Figure 5. CSPs need to define a clear long-term network-slicing roadmap.

- A clear methodology to identify the top verticals/use cases – basis internal strategic priorities, market needs, technology capabilities and readiness, ecosystem maturity, return on investment (ROI) analysis, etc.

- Intent to co-create slicing proof points with enterprises to be able to convince enterprises of the benefits of slicing

- Understanding of the right kind of industry expertise needed to develop customized GTM/vertical/value chain roles and how to develop such expertise. For example, build vs buy vs partnership, partner availability, etc.

- A clear roadmap to develop organizational capabilities to support slicing business

In a nutshell: Our advice moving forward

Network slicing is a near-term opportunity, and we are seeing CSPs deploying slices to address industry and consumer needs. All front runners are already exploring this technology, with some also evaluating various GTM and business models that can be used to provide slicing services.

Our final advice to CSPs is to keep the following points in mind when navigating key priority areas:

Don’t be afraid to start with what you have: Start small by leveraging existing technical capabilities, and gradually add complexities to scale.

Apply a business-led approach: Slicing is a business proposition and hence needs a business-focused approach. What this means is to explore network slicing working with enterprises by focusing on a few use cases and experimenting through lighthouse projects.

Engage and learn with the ecosystem: Employ a collaborative approach to develop E2E solutions irrespective of value chain play. CSPs must remember that when they build a solution, it’s not just about technology readiness but also about ecosystem readiness – this is particularly true for slicing because, as an emerging solution, it also requires CSP and ecosystem maturity.

Learn more:

- Read more about Network Slicing

- Read our blog posts: Network slicing opens up new monetization possibilities in 5G

- Value is at the heart of network-slicing monetization

- Download our white paper: 200 billion reasons to explore network slicing

- Explore our report: Time to accelerate network slicing monetization: 5G network slicing adoption in the Middle East and Africa